Suddenly lost faith in your SaaS provider? Here’s what you can do.

.webp)

Take a self-guided tour of the platform.

See why Vertice is trusted by top procurement leaders.

Most business-critical functions are underpinned by some sort of SaaS - whether communications, service delivery, the ability to make or take payments, or of course cybersecurity.

So what recourse do you have when a SaaS provider on whom you rely has an outage - whether specific to you or across their entire customer base - leaving you dead in the water until the outage is resolved?

How to respond when your SaaS provider has a serious outage

It will be very rare for you to immediately ‘switch’ to a different provider. Business-critical SaaS vendors will usually rely on long-term contracts rather than month-to-month rolling engagements.

So as insufficient as it may seem and as powerless as you may feel, your first course of action is simply to ensure you will be suitably compensated.

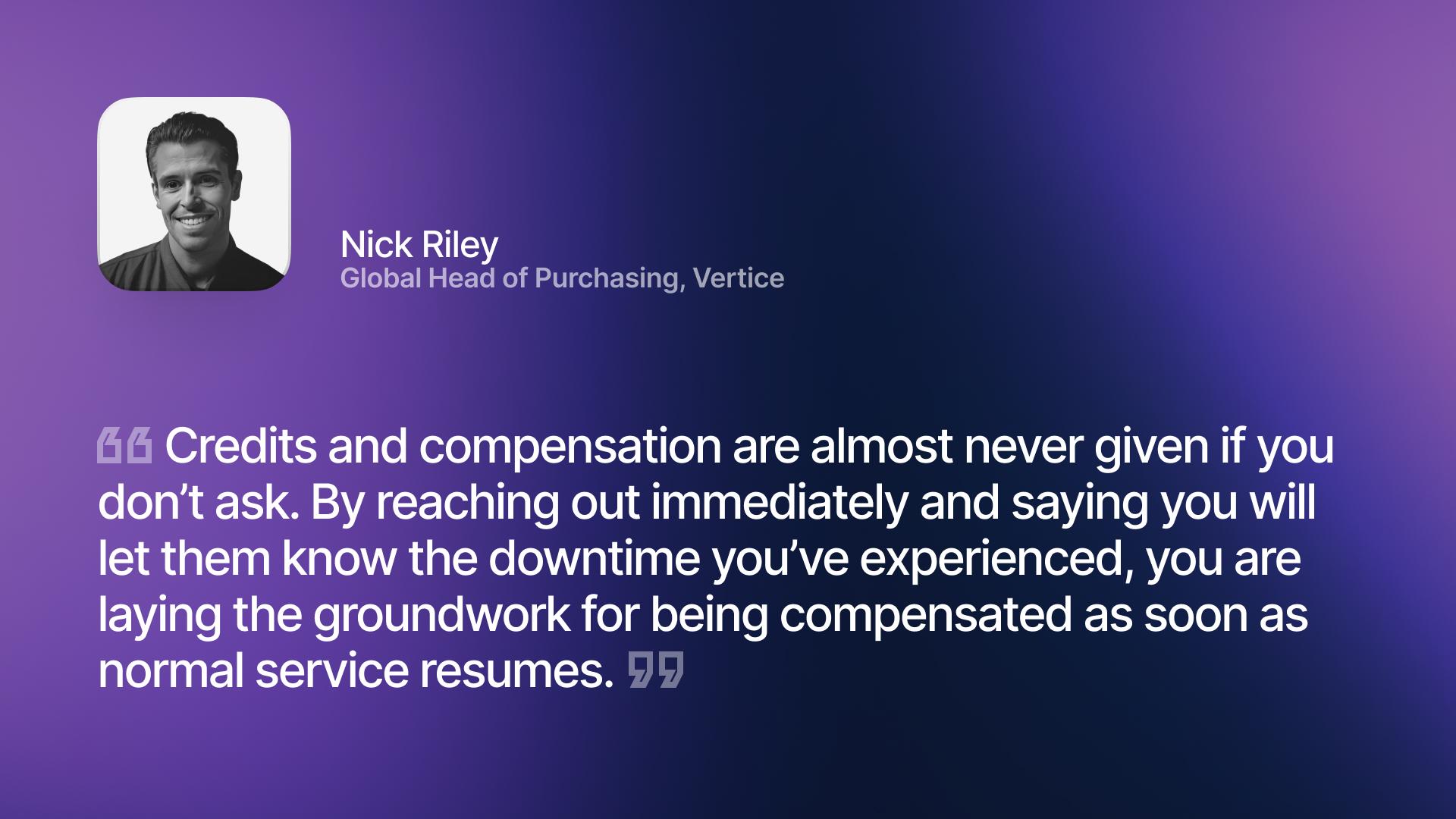

Nick suggests taking the following steps:

- Read through your SLAs and understand what degree of outage is and isn’t acceptable.

- Measure for yourself how long the disruption lasts - don’t just take the vendor’s word for it.

- Proactively reach out to your supplier to let them know you will be seeking SLA rebates once uptime has resumed.

- Usually you will have 30 days to request credits or compensation, but you will have to ask for them.

In the case of an extreme outage, you can also check your business insurance to see if it will provide compensation. Some cybersecurity insurance providers, for example, would cover a business interruption caused by a SaaS vendor’s ‘programming error’ or ‘human error’, though admittedly only under certain circumstances.

However in the aftermath of an outage, it is very difficult - in many cases, impossible - to retrofit justifications for when and why compensation should be due, and what ‘suitable’ means to you without agreed contract terms to lean on. Ironically, the vendor has much of the power.

Which means de-risking your contract and your vendor relationship starts at the beginning.

How to de-risk SaaS renewals or new purchases

When negotiating contracts, it’s easy to focus solely on the commercials. However, almost no amount of discount will compensate for impeding your ability to function as a business.

So instead, pre-empt short-term crises such as outages during contract negotiations, so you can insert clauses that de-risk the relationship with your provider.

Doing so will not only cover you for these situations, but also provide clarity about what to do should the situation occur, and what to expect from each party.

Here are some examples of what you can request

- A policy that includes automatic compensation from provider outages should be top of the list. This not only ensures you are financially covered for any reduction in service, but also saves you from 30-day request periods.

- Look closely at the Limitation of Liability section in their standard contract. This tells you what the vendor considers themselves responsible for in a downtime event. But it also tells you what they don’t think they should be responsible for, and you can negotiate these to cover SLA drops and overall outages.

- Consider negotiating a termination clause based on SLA performance, whether for persistent underachievement or any one-time total non-provision of service. Vendors may not be as willing to include break clauses without some sort of extra cost though, so you need to weigh up if the inclusion of one is worth the additional spend.

What concessions are you willing to give?

In negotiating these requests, it’s unlikely that a vendor will accept your demands without gaining something that’s beneficial for them. So it’s crucial to know what concessions you are willing to give before going into negotiations, as well as protecting your relationship with the vendor.

Areas like automatic compensation for SLA failures or outages may mean that the overall contract price increases. Is this extra cost something you can tolerate, and if so by what degree? Of course, if you have business insurance that covers these areas, you may feel these terms are unnecessary.

Alternatively, can you give something to the vendor that benefits them another way? For example, if you have a lot of reach in your industry or a strong brand name, can you agree on a co-marketing opportunity such as agreeing to be a case study? These types of non-financial agreements are often a powerful way of securing new terms without extra payments.

How do you achieve this?

At the end of the day, no contract terms can prevent your SaaS providers’ human or technical errors from causing you to have a major outage. As such, perhaps ‘de-risking’ is the wrong word to use - you can never totally remove that risk no matter what your contract contains.

But you can make compensation and even escape from the contract easier, provided the negotiation is handled in the correct manner.

Vertice’s expert buyers handle hundreds of SaaS negotiations every day. With experience and benchmarking data across 16,000+ vendors, there simply isn’t a scenario they haven’t come across. Which is why finance and procurement leaders around the world rely on Vertice to handle their SaaS contract purchasing and renewals.

Find out more about the typical impacts we have for these organizations or, if you have a contract negotiation coming up, talk to us about how we may be able to help.

.webp)

![The Best SaaS Management Platforms for 2026 [According to Analyst Research]](https://cdn.prod.website-files.com/6640cd28f51f13175e577c05/687f56f6e55f8c0078341eb6_2025-06-Lionfish-Tech-Advisors-Report-01-1080x1080.webp)

.webp)