Despite the majority of businesses continuing to be hit by unfavorable macroeconomic conditions, data from Deloitte reports that an increasing number of CFOs – at least those across Europe – are starting to feel mildly optimistic about their organization’s financial prospects.

But with inflation remaining high, it comes as no surprise that cost reduction remains the biggest strategic priority.

While there are a number of approaches a business can take to reduce outgoings, an often overlooked area of spending is SaaS. Accounting for $1 in every $8 of total expenditure, software is not only a huge contributor of indirect spend, but 90% of companies are overpaying for each application – in many cases as many as 130 tools – by an average of 26%.

Making sure you’re pulling all the levers necessary to keep your SaaS spending to a minimum is therefore key – now more than ever. This means ensuring that you’re only subscribing to the tools and licenses that are actually required, and that you’re securing the best possible price and terms on any given contract.

Something that is often easier said than done without the right intel though.

At Vertice, we strive to provide you with this intel. We do this by sharing exclusive pricing and discounting data in our vendor hub, while also continuing to to share our monthly roundup of SaaS purchasing insights.

With this in mind, here’s our roundup for June.

SaaS purchasing insights

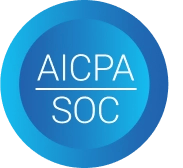

Sales software now account for over a quarter of total SaaS spend

Between Q1 and Q2 of 2023, we saw the share of spend for sales software applications increase from 21% to 28%, meaning that these tools now account for more than a quarter of total software spend – not far off a third.

So, while organizations in general are becoming increasingly selective about the contents of their SaaS stacks, with data indicating that many are opting to cut back on marketing and HR tools – a possible result of reduced headcount and budget cuts – this increased share of spend for sales software signifies the importance of these tools in helping businesses either sustain growth or scale.

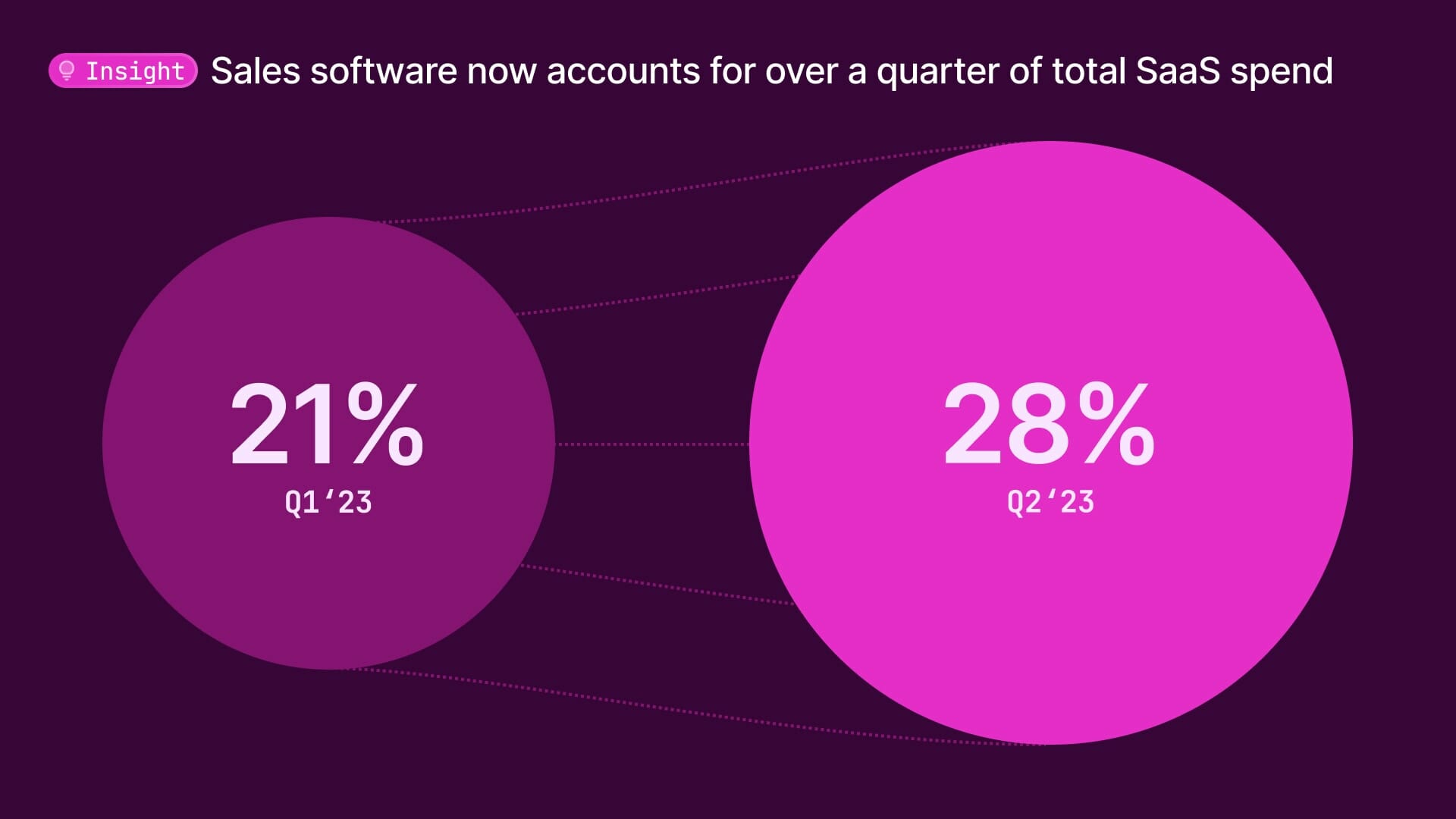

Despite this, license utilization remains a huge challenge. Not only do sales tools account for substantially more spend than any other type of tool used within the average business, but they remain the least utilized by far.

According to our data, just under half of all licenses are either barely used or not used at all by the intended employees. While there has been marginal improvement since Q1, with utilization rates up from 48% to 51%, the fact that overall share of spend has increased means this is potentially an even bigger problem than it previously was and is an area of increasingly wasted spend.

When you consider the fact that companies spend $9,000 on software for every sales representative – almost double the $4,552 average that is spent on employees in other departments – you could be wasting as much as $4,410 on every sales employee. That’s not far off a quarter of million dollars being wasted on unused sales tools and licenses every year for organizations with 50 sales reps.

Getting on top of this issue starts with rightsizing your stack and ensuring that procurement is being handled by the right teams. This, combined with a solid SaaS negotiation strategy, will put you on the path to maximum cost-savings in this area.

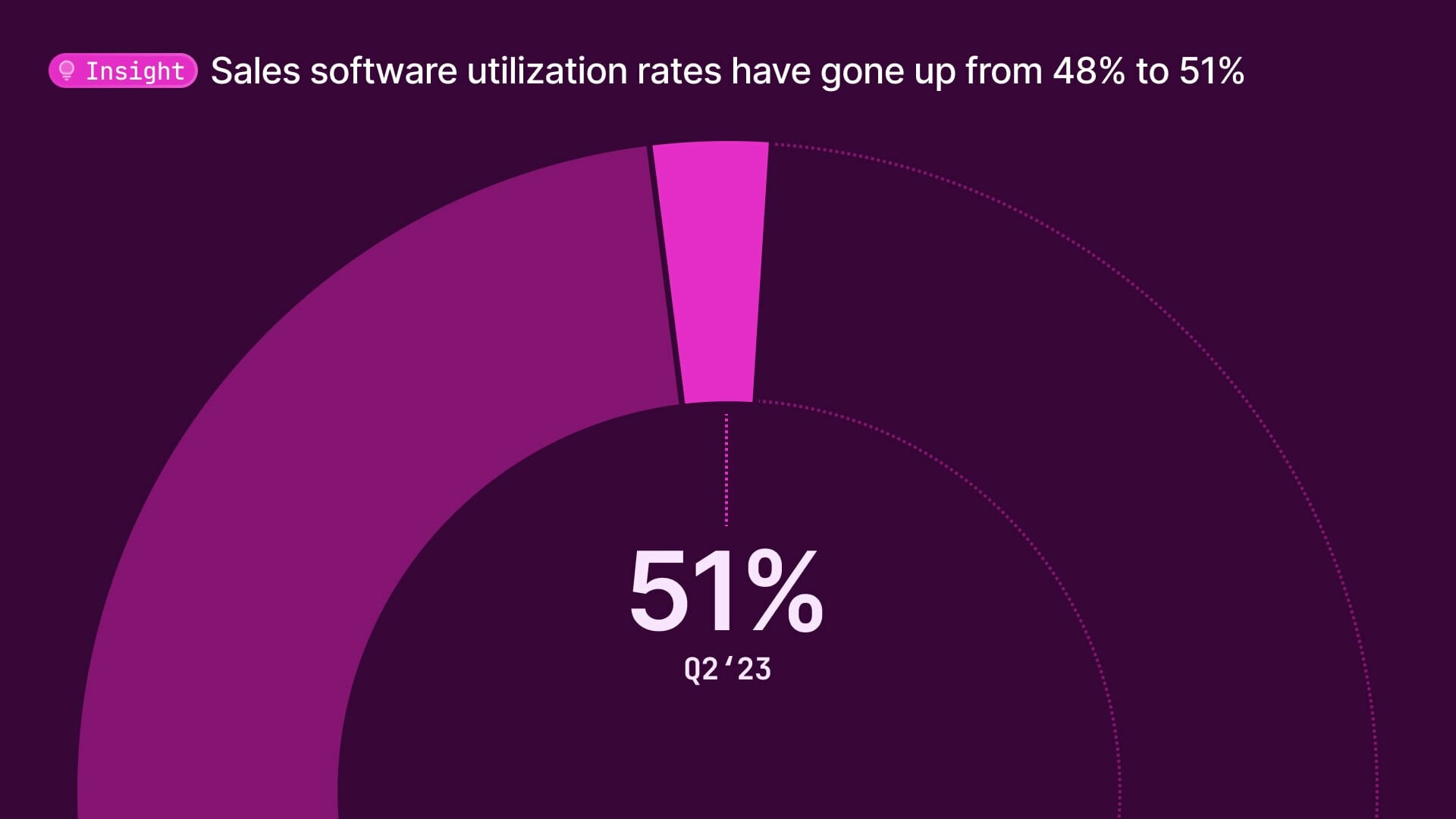

SaaS vendors increased their discounts in Q2

According to our data, the average discount offered by SaaS vendors has increased across the majority of software categories since Q1 of this year. This could well be the result of companies becoming more frugal with their budgets in light of soaring inflation rates.

While the data specifically found that the average discounts offered by vendors in sectors such as CRM, identity access management, and software development had the most notable increases, no category upped its average discounting quite as much as the sales intelligence software sector.

Despite having previously offered generous average savings of 36%, vendors in this space have since increased this to a substantial 43%. This means that those purchasing or renewing a sales intelligence tool are, on average, paying not far off half the prices advertised.

So, why is it that so many vendors are becoming more generous with their pricing?

One reason could be a potential shift in purchasing power. With so many companies cutting back on tools that aren’t deemed to be business critical, providers are needing to do all they can to not only retain existing users, but also attract new ones. Especially given that so many will be facing the same financial challenges as the businesses they sell too – as has been made apparent in the mass layoffs and declining growth rates in SaaS.

Hefty discounting is one way for them to ride out the economic storm.

Trending SaaS vendors

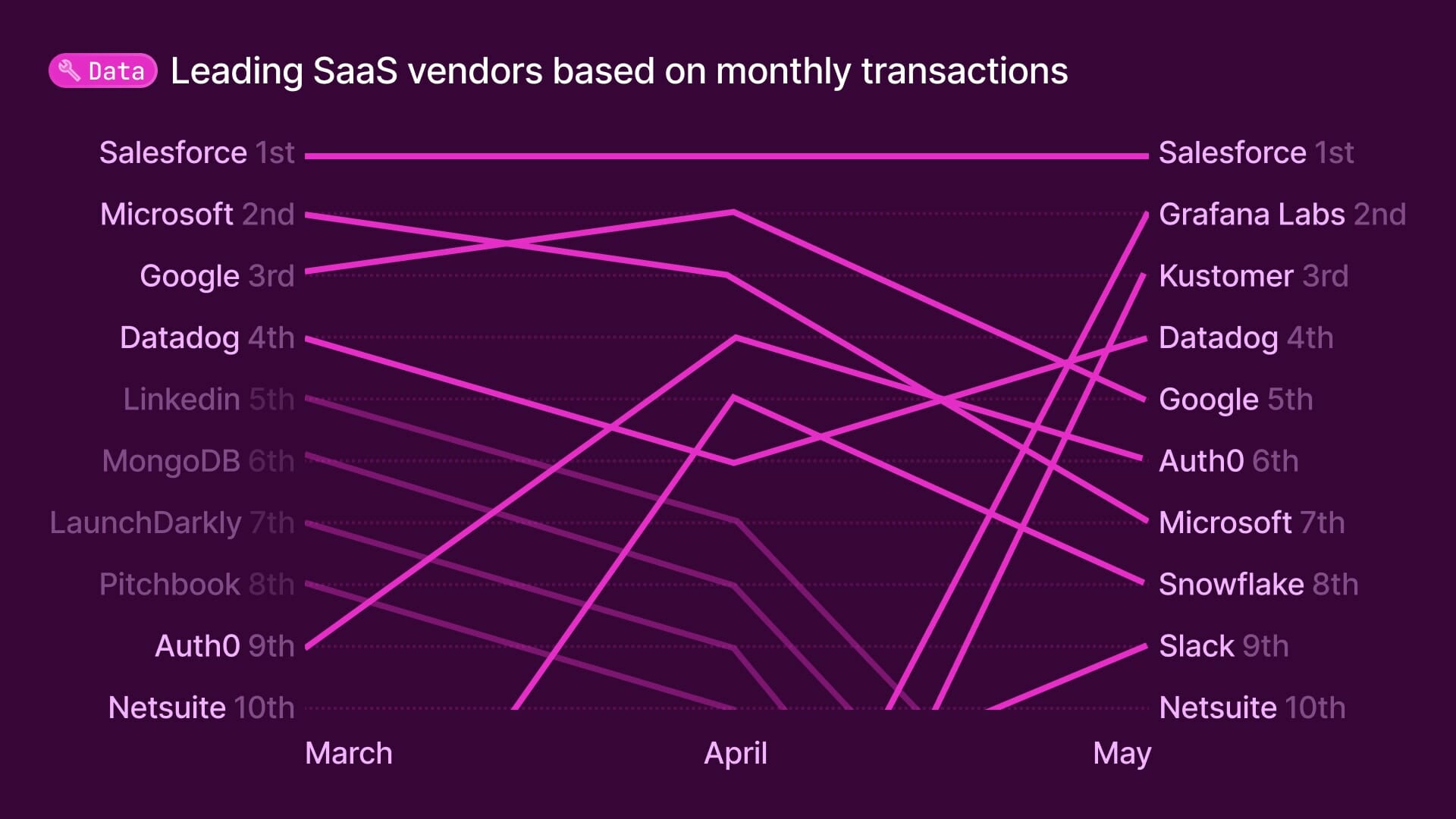

Each month, we’ll be continuing to look at the top SaaS vendors by the total contract value (TCV) of new transactions across our user base – both new purchases and renewals – and tracking their monthly movements.

While Salesforce remains the leading SaaS vendor for the fourth month running, new entrants Grafana Labs, an application performance monitoring provider, and CRM platform, Kustomer, had the second and third highest TCV across our user base this month, pushing both Google and Microsoft down the rankings.

They’re not the only vendors to have fallen though, with Auth0 and Snowflake dropping to 6th and 8th place, while LinkedIn, MongoDB and LaunchDarkly dropped out of the top ten altogether.

Interestingly, communications tool Slack features for the first time and business software suite, NetSuite, has made a reappearance.

Rising vendors

Not only did Grafana Labs and Kustomer have the second and third highest TCV in terms of new transactions in June, but they both also experienced the largest month-on-month increase, positioning them as two of our three rising vendors, along with cross-channel marketing platform, Iterable.

Falling vendors

Vendor of the month: Grafana Labs

Open source analytics and monitoring solution, Grafana Labs, soared into second place this month in terms of the number of new purchases and renewals we’ve seen across our user base. This puts the company ahead of the likes of Google, Microsoft, and even last month’s vendor of the month, Snowflake.

Just last year, the company passed more than one million active users and secured a $240 million Series D round of funding, so it comes as no surprise that the company is becoming a firm favorite.

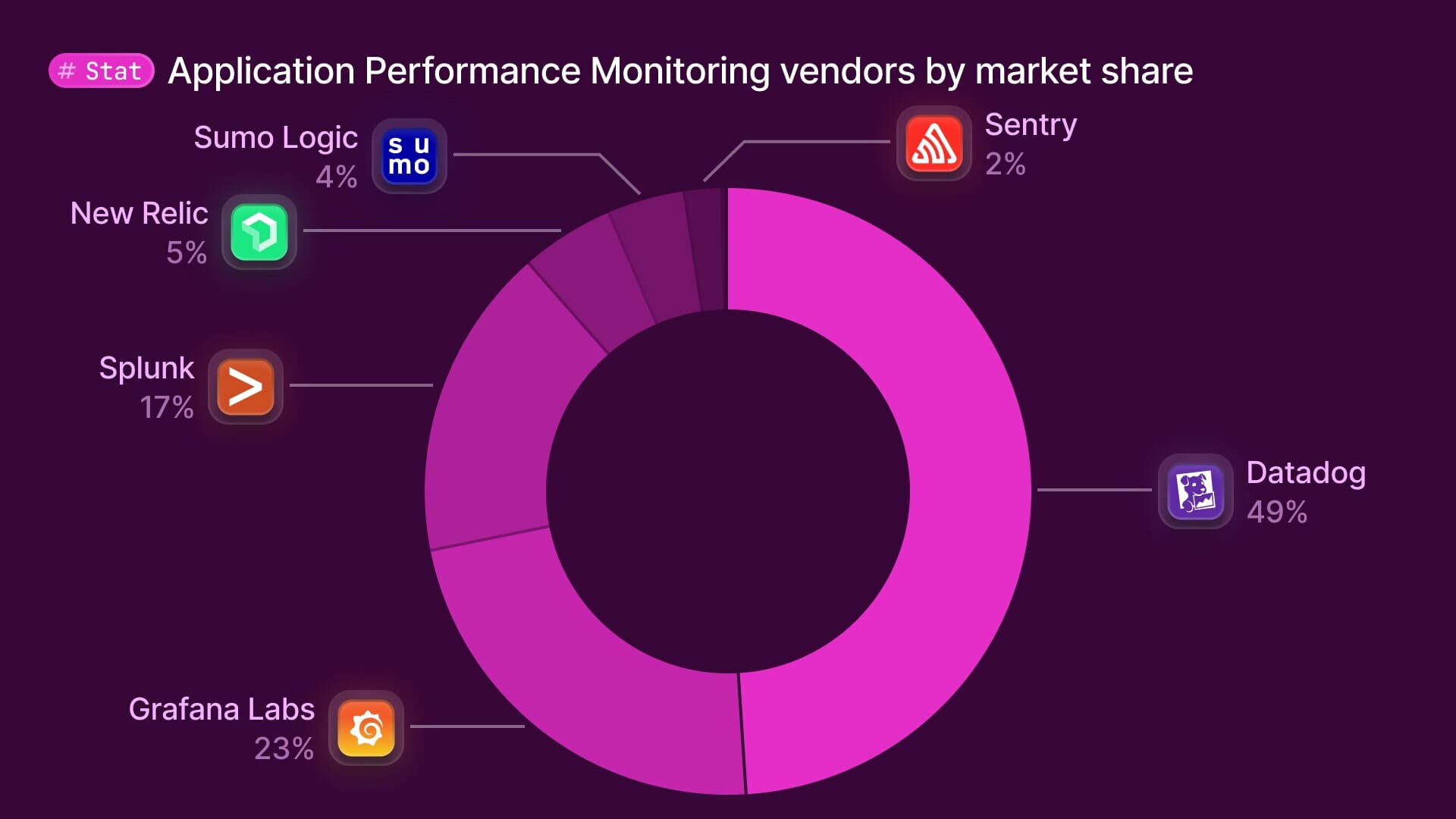

SaaS category of the month: Application Performance Monitoring

The Application Performance Monitoring sector has seen huge growth in recent years and it’s showing no signs of slowing down, with Gartner expecting the market to reach an estimated $8.9 billion by 2026.

In fact, our own data backs this up, having found that this type of software now accounts for 13% of total SaaS spend, up from 11% in Q1.

While Grafana Labs had the highest number of transactions in June across our user base, second only to Salesforce, market leader Datadog wasn’t far behind in fourth place. This further highlights just how crucial application performance monitoring software is as a solution across companies of all sizes and industries.

As with any SaaS tool though, there are often savings to be had, with list prices rarely set in stone. Additional data shows that the average discount offered by companies in this sector is 21%.

See how much you could be saving on your annual software spend

Get the best deal, every time

With access to the pricing and discounting data for more than 13,000 global software providers, Vertice can see what organizations like yours are actually paying for their tools, using this insight as leverage in negotiations.

Working on your behalf, our expert team of SaaS purchasers will not only secure you the very best price and terms on any contract, but we’ll also reduce the burden that often comes with buying, renewing and managing software, while still giving you full visibility of your entire SaaS stack.

See for yourself how much time and money you could be saving on SaaS with a free audit, or alternatively browse through our database for exclusive pricing insights on thousands of vendors.