SaaS may well have transformed the way that almost every team within an organization operates, but the amount being spent on this software — both as a total and by headcount — is by no means an equal split.

Within the average company, sales teams are spending substantially more on SaaS than any other department and this share of spend is showing no signs of slowing down. In the last month alone, it’s increased from 18% to 21%.

Which means that sales tools now account for more than a fifth of all software spend.

The question is, why? Why is SaaS spending so much higher in sales than in any other department?

In short, there are a number of reasons — an overwhelming lack of pricing transparency in this sector, underutilization of tools, a growing sales SaaS stack, and lack of effective negotiation power.

But despite each of these contributing to increased spend, there are ways you can keep the cost of these tools to a minimum.

You just need to know where to start. More specifically, you need to know who to start with.

Why sales leaders shouldn’t be the ones to negotiate SaaS

Wasted SaaS spend is often the result of two things — lack of visibility and a decentralized purchasing process.

But while this problem isn’t unique to sales teams, the fact that this department not only purchases more software than any other, but also has the lowest SaaS utilization rates, certainly makes it a business area worth focusing on if you’re looking to drive down costs.

Let’s look at some of the facts.

In the average business, sales teams purchase substantially more tools and licenses than are needed. In fact, only 48% are actually utilized, with 52% either barely used or not used at all by the intended employees. Across other areas of the business, SaaS tool underutilization sits around the 33% mark.

But what does this mean in monetary terms? Well, with companies spending $9,000 on SaaS for every sales representative — which is already almost double the $4,552 that is spent on employees in other departments — you could be wasting as much as $4,680 per person.

With a team of 50 sales reps, that’s close to a quarter of a million dollars being spent on unused sales tools and licenses every year. And that’s not even considering SaaS wastage in other departments.

It’s not the only issue though. Our data further shows that 16% of sales representatives are on tiers that are more expensive than their usage would require.

The bottom line is that while these sales tools have become a crucial part of any revenue stack, they are often purchased with little consideration to actual usage requirements. Which means that sales leaders — or any department lead for that matter — shouldn’t be procuring or renewing their own team’s tools.

So, who should be?

In short, either the finance, IT or procurement team. Or better yet, an intermediary that will not only secure you the best possible price on your SaaS and save you a substantial amount of time purchasing and renewing these tools, but that will also negotiate terms based on the actual needs of your business.

Other factors driving up the cost of sales software

It’s not just sales tool utilization — or lack of — responsible for increased spend on sales software. There are other factors that are driving up the cost of these sales tools.

SaaS pricing inflation

Perhaps the biggest reason why sales software is costing organizations so much money is largely because of SaaS pricing inflation.

In other words, the cost of these tools are increasing. And they’re increasing substantially.

According to data from our SaaS pricing inflation report, software prices are rising at a rate that far outpaces general market inflation. Yet, many vendors continue to use inflation as a scapegoat for their soaring prices.

Which leads us on to another issue…

Lack of pricing transparency

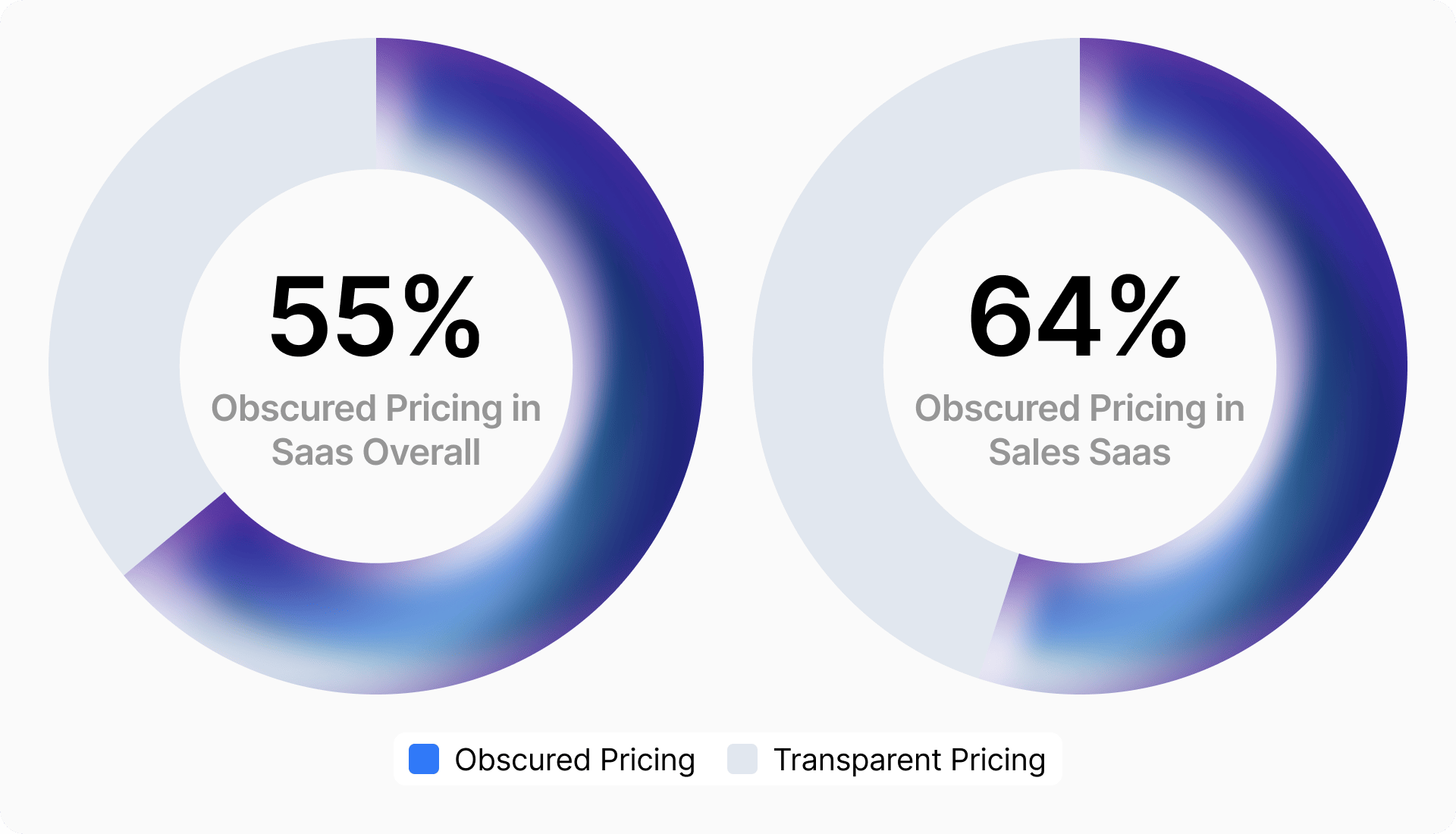

The overwhelming lack of pricing transparency in the market is a huge problem for SaaS buyers in general. But it’s even more of a challenge for those purchasing sales software.

This is because as many as 64% of vendors in this space obscure their pricing, which is higher than the 55% average.

So, why is this a problem?

Well, with no frame of reference on what other companies are being charged, it’s difficult to know if you’re getting a good deal, let alone the best possible deal on your software. Ultimately, it leaves the vendor with all the power.

But this doesn’t have to be the case. At least not when you have the leverage.

How to secure the best possible price on your sales software

The reality is that there are often stark differences between what sales tool vendors want you to pay and what other companies are actually paying.

In fact, according to the data outlined in this report, the average real price paid for sales software is 22% lower than list pricing, with some vendors offering discounts as high as 40%.

The question is, how do you achieve these discounts?

In short, with Vertice.

With access to the pricing and discounting data behind more than 13,000 global SaaS vendors, we can see exactly what organizations like yours are actually paying and use this as leverage in negotiations, working on your behalf to secure the best possible terms and price on any SaaS deal.

But that’s not all we do.

Through the Vertice platform, we provide you with visibility into all of your SaaS contracts and renewal deadlines, while also helping you understand if these tools are being utilized and where cost saving opportunities may exist within your SaaS stack.

Want to learn more about how Vertice can help you save on SaaS? Take a look at this, or alternatively see exactly how much you could be saving with this cost saving analysis tool.