With the cost of just about everything continuing to surge, finance leaders remain on the lookout for ways to reduce expenditure. While there are a number of options for achieving this, one of the biggest opportunities lies with SaaS.

Accounting for $1 in every $8 spent within the modern organization – a number that may well increase in the coming years thanks to advancements in technology and soaring inflation rates – companies can no longer run the risk of leaving their software stacks proliferating in the background and contributing to an unimaginable amount of wasted spend.

But while there are a number of cost-saving techniques that are being adopted, from SaaS license utilization to price benchmarking, another less talked about approach is that of foreign currency transactions in software procurement.

In other words, taking advantage of currency drift to purchase SaaS tools at more favorable rates.

But what exactly is currency drift? How can you leverage it to reduce the cost of your subscriptions? And what considerations should be taken into account before making the decision to pay for software in a foreign currency?

Here’s everything you need to know.

What is currency drift and how can you leverage it to reduce the cost of software?

Announcements of SaaS price increases may have dominated the tech news in recent months, but the reality is that software companies don’t update their pricing on a regular basis. At least not anywhere near enough to keep up with currency fluctuations.

For savvy SaaS buyers, this can provide a lucrative opportunity to secure a cheaper deal on their software subscriptions.

But how does it work?

In short, when exchange rates fluctuate – a process known as currency drift – the value of any given currency subsequently changes. When a particular currency weakens, for example the US dollar, purchasing power in other foreign currencies becomes stronger.

This creates pricing discrepancies, which in turn creates an opportunity for companies to purchase SaaS in a currency that has weakened relative to their own. Something known as arbitrage pricing.

Can I pay for software in a different currency?

In short, yes.

While there are of course considerations that should be taken into account if your business doesn’t already operate in multiple currencies, it is certainly possible to purchase or renew software in something other than your local currency.

But while there can be fees associated with doing so, taking advantage of currency drift and subsequently pricing arbitrage, can potentially offer substantial cost savings.

Just take the following example.

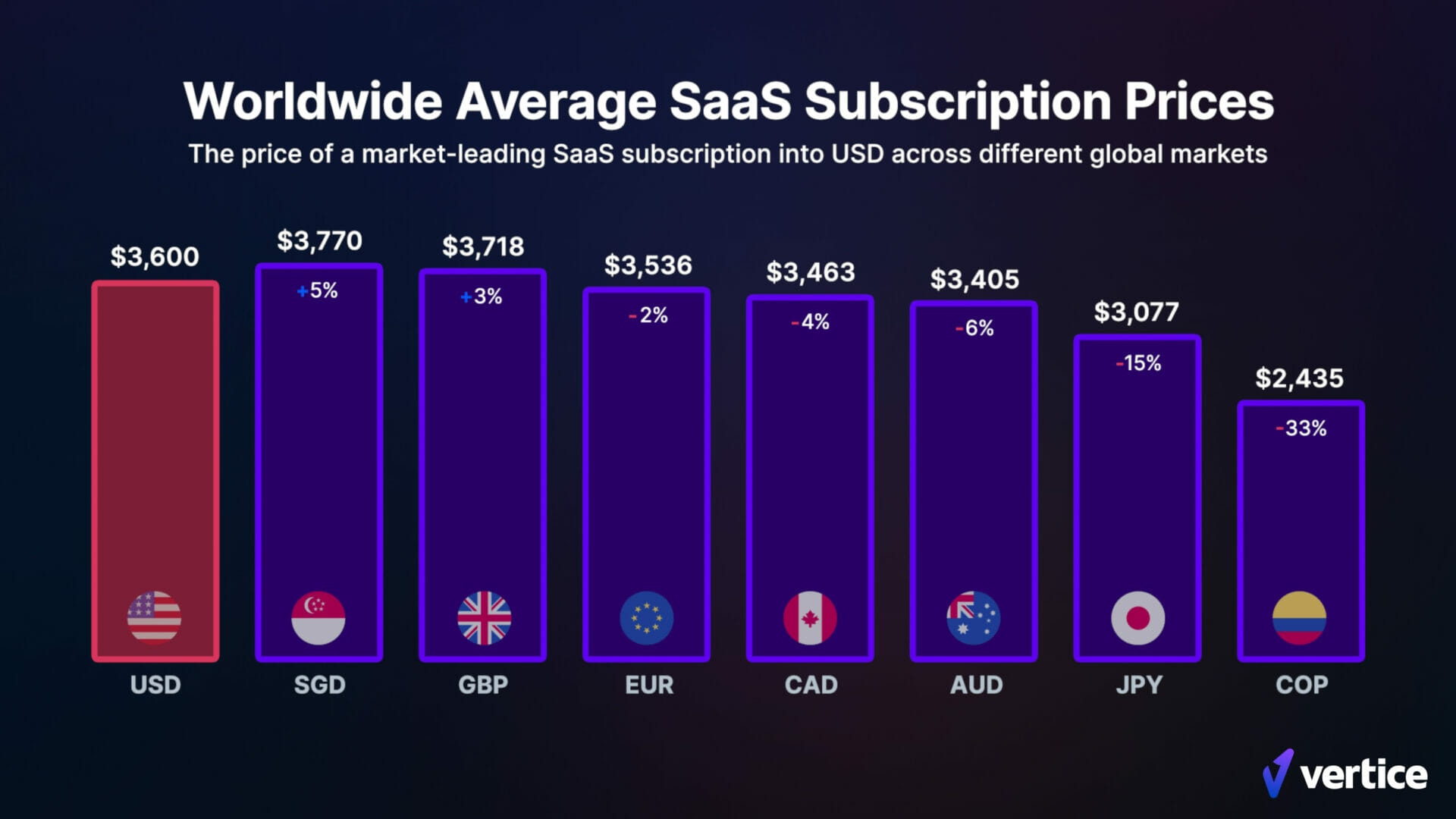

As with any global SaaS platform, pricing is often displayed in multiple currencies. In some instances, there are numerous options, as is the case for one industry-leading tool.

While the enterprise-level plan for the platform in question starts from 3,600 USD per month, a simple conversion of the seven additional currencies indicates that the US dollar equivalent varies significantly.

At the time of writing, this particular platform costs a US company more to purchase or renew in its local currency (US dollar), than it would to pay in any currency other than GBP (British Pound Sterling) or SGD (Singapore dollar).

The most stark difference in pricing though is the Colombian Peso.

Based on current exchange rates, the COL$10,800,000 monthly price tag is equivalent to $2,437, which is more than a $1,000 difference than paying in USD. The cost in Japanese Yen is equivalent to just over $500 less.

Things to consider when purchasing software in a different currency

The first thing to note is that if your business already has a bank account in the currency you’re wanting to pay with, then the operational impact for paying for SaaS in a foreign currency will be minimal. In this instance, it would just be a simple same-currency transaction.

If you’re not yet equipped to handle foreign currency transactions though, there are things you’ll need to take into account in order to avoid incurring hefty additional fees.

So, to help you make an informed decision as to whether it makes financial sense to pay for your software in a different currency, we asked the experts at Global Payments Provider, Airwallex.

What considerations should be taken into account when deciding to pay for a SaaS subscription in a foreign currency?

Avoid the conversion trap! When businesses are receiving funds from clients abroad or spending overseas, they need to be mindful not to fall into conversion traps that can erode their precious margins.

A domestic bank may charge unnecessary fees and cause delays when sending funds internationally. It’s wise to check how much a SWIFT payment will cost for each payment and how much this would add up to over the year. Similarly, if you’re using corporate cards, be sure to check what conversion rates will be used and if there are additional fees for spending in foreign currencies.

Before signing up to a software subscription in a foreign currency, any business should ultimately ask itself:

- What bank accounts do I hold overseas to make the payment?

- What method of payment do they prefer?

- What costs will be incurred for each transaction?

Your global payments and financial infrastructure should be able to answer each of those questions and, ideally, you’ll want it all from one provider.

What costs are typically incurred when making payments in a foreign currency?

Banks will typically charge both a cross-border fee and a conversion fee when sending money internationally. Quite often, overseas payments will rely on the SWIFT network which can be costly and result in unnecessary delays, with funds often in limbo for up to 4-5 days.

You should also look out for the foreign exchange rate, conversion fee, and/or the cross-border fee (which can be anything from 1-3%) being offered when comparing providers.

A word of caution, the conversion fee is often hidden within the transactions, so you lose visibility on the markup – some quick math will tell you what the markup is though. At Airwallex, we make a point to list the conversion fee and we don’t charge a cross-border fee. Furthermore, our cards are multi-currency so they draw from the correct currency inside your wallet, meaning you don’t have to pay the conversion fee unnecessarily.

Additional ways to reduce SaaS spend

Leveraging currency drift can be a smart way to reduce SaaS spend, but it’s by no means the only way.

In fact, with as many as 90% of companies overpaying for each software application by an average of 26%, you have a huge opportunity to substantially drive down your annual software spend. As long as you have the right leverage, that is.

With access to the pricing and discounting data for more than 16,000 SaaS providers worldwide, we can not only provide you with this leverage, but we can also use it to negotiate on your behalf, ensuring you’re getting the best possible deal on any software contract.

That’s not the only way we can deliver you SaaS savings though.

We also continually look for ways to streamline your SaaS stack, for example by flagging instances of over-licensing, as well as any duplicate tools and unused applications that exist within your portfolio.

See for yourself how Vertice’s usage analytics and discovery capabilities can provide you with invaluable software utilization insights and cost-savings. Alternatively, access exclusive pricing and discounting intel for thousands of SaaS providers by browsing through our vendor database.