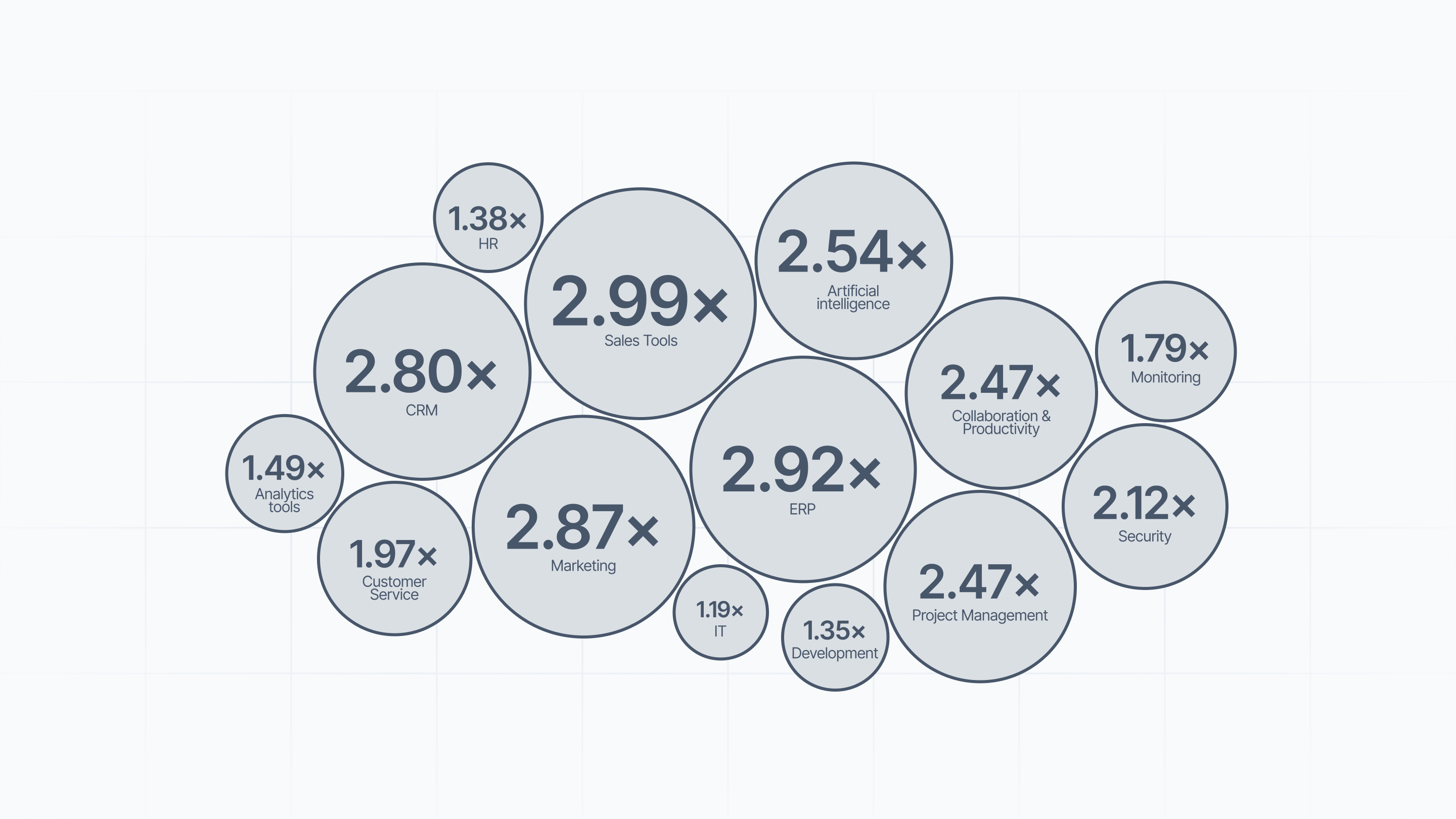

SaaS benchmark prices deviation

Pricing remains inconsistent across almost all software categories

SaaS pricing remains highly fragmented, with companies often paying close to 3x more than their peers for comparable software. Sales (2.99x) ERP (2.92x) and marketing (2.87x) exhibit the highest levels of price dispersion – volatility that is often driven by complex bundling, making procurement benchmarking data all the more essential.

Conversely, the market is seeing a move toward standardization in categories such as IT infrastructure (1.19x) and development (1.35x), indicating more rigid and transparent pricing models. For the majority of tools, however, the gap between the 20th and 80th percentile remains wide, with this pricing disparity resulting in significant overpayment for many organizations.

Last updated

Jan 2026

Give your tech stack and processes a health-check

Discover your procurement maturity level, benchmark yourself vs your peers, and be shown where to improve and how.

.webp)

See how much you could be saving on SaaS in 2026.

Get a tailored demo of Vertice and see why 500+ global brands trust us to optimize their spend.

See how simple procurement can be

Let us show you how to halve your cycles and cut costs by 20%.

Related insights

All insights

Join the community

Get the latest insights, exclusive event invitations and subscriber-only content from thought leaders that'll help you drive real change.

.webp)